The Energy Policy Act of 2005 (Pub.L. 109-

Provisions

General provisions

Authorizes loan guarantees for "innovative technologies" that avoid greenhouse gases, which might include advanced nuclear reactor designs (such as PBMR) as well as clean coal and renewable energy;

Increases the amount of biofuel (usually ethanol) that must be mixed with gasoline sold in the United States to 4 billion gallons by 2006, 6.1 billion gallons by 2009 and 7.5 billion gallons by 2012;

Seeks to increase coal as an energy source while also reducing air pollution, through authorizing $200 million annually for clean coal initiatives, repealing the current 160-

Authorizes subsidies for wind and other alternative energy producers;

Adds ocean energy sources including wave and tidal power for the first time as separately identified, renewable technologies;

Authorizes $50 million annually over the life of the law for biomass grants;

Contains provisions aimed at making geothermal energy more competitive with fossil fuels in generating electricity;

Requires the US Department of Energy to study and report on existing natural energy resources including wind, solar, waves and tides;

Authorizes the Department of the Interior to grant leases for activity that involves the production, transportation or transmission of energy on Outer Continental Shelf lands from sources other than gas and oil (Section 388);

Requires the U.S. Department of Energy to study and report on national benefits of demand response and make a recommendation on achieving specific levels of benefits and encourages time-

Requires all public electric utilities to offer net metering on request to their customers;

Requires the DOE to designate National Interest Electric Transmission Corridors where there are significant transmission limitations adversely affecting the public. The Federal Energy Regulatory Commission may authorize federal permits for transmission projects in these regions.

Provides tax breaks for those making energy conservation improvements to their homes;

Provides incentives to companies drilling for oil in the Gulf of Mexico;

Exempts oil and gas producers from certain requirements of the Safe Drinking Water Act;

Extends daylight saving time by four to five weeks, depending upon the year (see below);

Requires that no drilling for gas or oil may be done in or underneath the Great Lakes;

Requires that Federal Fleet vehicles capable of operating on alternative fuels be operated on these fuels exclusively (Section 701.)

Sets federal reliability standards regulating the electrical grid (done in response to the Blackout of 2003);

Nuclear-

Extends the Price-

Authorizes cost-

Authorizes a production tax credit of up to $125 million total per year, estimated at 1.8 US¢/kWh during the first eight years of operation for the first 6.000 MW of capacity ; consistent with renewables;

Authorizes $1.25 billion for the Department of Energy to build a nuclear reactor to generate both electricity and hydrogen;

Allows nuclear plant employees and certain contractors to carry firearms;

Prohibits the sale, export or transfer of nuclear materials and "sensitive nuclear technology" to any state sponsor of terrorist activities;

Updates tax treatment of decommissioning funds;

A provision for the U.S. Department of Energy to report in one year on how to dispose of high-

Directs the Secretary of the Interior to complete a programmatic environmental impact statement for a commercial leasing program for oil shale and tar sands resources on public lands with an emphasis on the most geologically prospective lands within each of the states of Colorado, Utah, and Wyoming.

In Congressional bills an "authorization" of a discretionary program is a permission to spend money, while an "appropriation" is the actual decision to spend it; none of the authorizations above will mean anything if the money is never appropriated.

Tax reductions by subject area

$4.3 billion for nuclear power

$2.8 billion for fossil fuel production

$2.7 billion to extend the renewable electricity production credit

$1.6 billion in tax incentives for investments in clean coal facilities

$1.3 billion for conservation and energy efficiency

$1.3 billion for alternative motor vehicles and fuels (bioethanol, biomethane, liquefied natural gas, propane)

$500 million Clean Renewable Energy Bonds (CREBS) for government agencies for renewable energy projects.

Commercial building deduction

The Act contains provisions for commercial buildings that make improvements to their energy systems. Energy improvements completed in 2006 and 2007 are eligible for tax deductions of as much as $1.80 per square foot. The incentives focus on improvements to lighting, HVAC and building envelope. Improvements are compared to a baseline of ASHRAE 2001 standards.

Many buildings are eligible for tax deductions for improvements completed or planned within the normal course of business, and can thus "free ride" for the new incentives. Achievement of these benefits requires cooperation between the facilities/energy division of a business and its tax department. A tax advisor with engineers on staff may serve as a bridge between these two historically separate business divisions. For municipal buildings, benefits are passed through to the primary designers/architects in an attempt to encourage innovative municipal design.

Energy management

The commercial building tax deductions can be used to improve the payback period of a prospective energy improvement investment.

Often the deductions are combined with participation in demand response programs where buildings agree to curtail usage at peak times for a premium.

The most common qualifying projects are in the lighting area. Industrial spaces such as Manufacturing, Warehouse and Distribution Centers are typically lit with 400W Metal Halide fixtures. These fixtures are commonly being upgraded with Hi-

Department of Energy

eorge Walker Bush; born July 6, 1946) served as the 43rd President of the United States from 2001 to 2009. He was the 46th Governor of Texas from 1995 to 2000 before being sworn in as President on January 20, 2001.

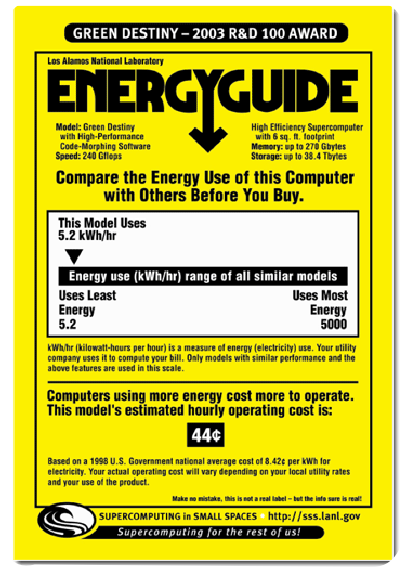

Energy Card attached to appliances and equipment to show its electrical efficiency ratings.